How to use myBankStatement with Lendsqr for credit scoring

myBankStatement gives lenders access to key financial data, helping them make more informed decisions with a clearer view of borrowers' financial profiles.

The 4 best Monnify alternatives for virtual accounts

Even with Monnify’s solid reputation, you may have specific business needs, pricing differences or want specific features so your business might benefit from exploring other options.

How to spot risky loan guarantors and protect yourself as a lender

A loan guarantor is basically like a secondary borrower. If they can't pay up when the borrower defaults, then having them as a guarantor is pointless.

6 practical tips to reduce loan processing times

Fast loan processing doesn’t mean approving all loan requests, but deciding if a loan should be approved or not shouldn’t take forever.

How to use Route Mobile with Lendsqr for sending SMS

Once you have your Route Mobile API key, log in to your Lendsqr account. Reach out to our product support team at [email protected] and get set up in 10 minutes.

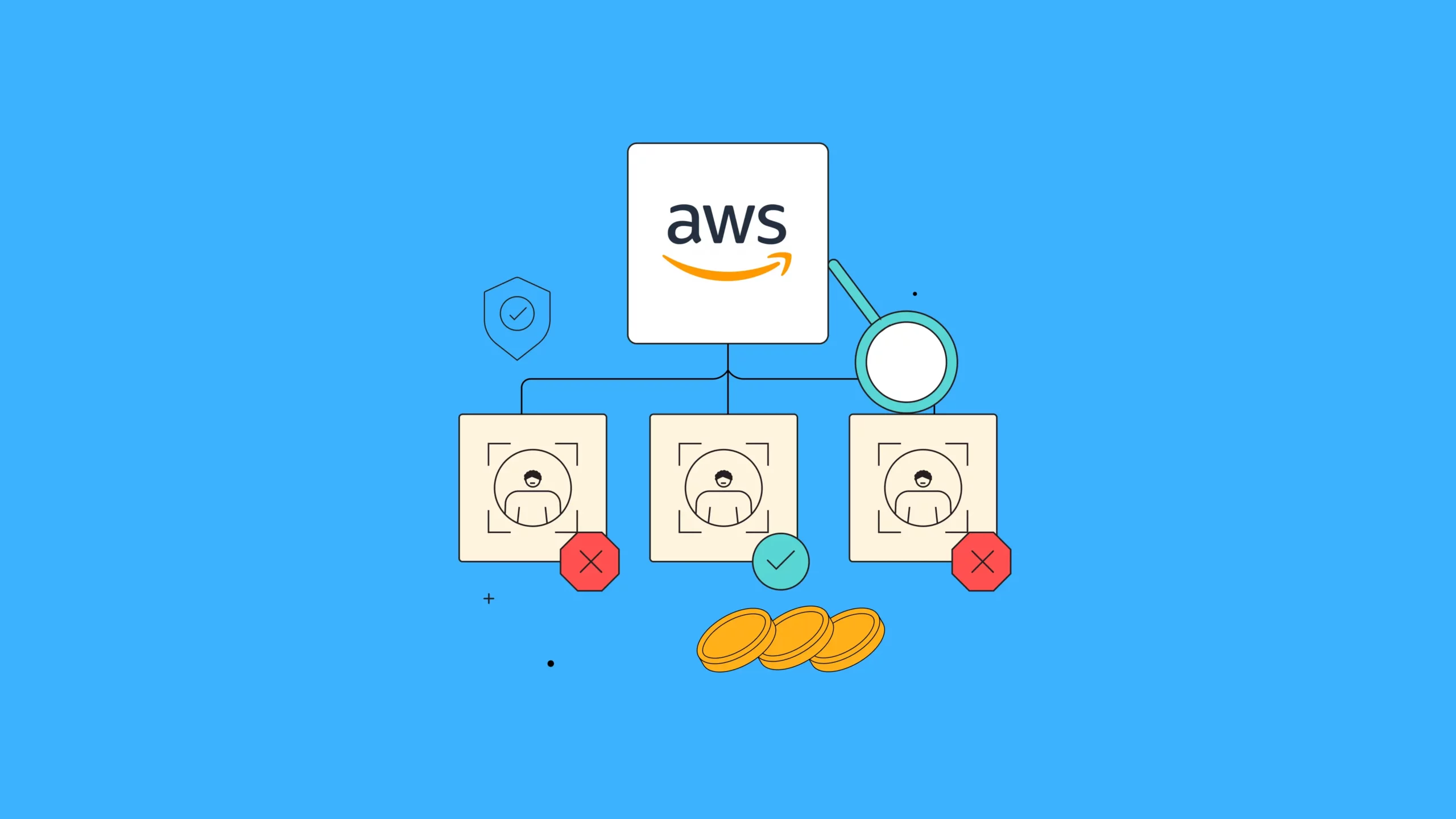

How we used AWS to build our identity and liveness system

Identity verification and liveness checks are central to lending. Learn how we used AWS to build our identity and liveness system.

How to set up CRC Credit Bureau for Lendsqr

One of the most critical tools you must have in your arsenal as a lender, is a credit bureau(s). Learn how to set up CRC Credit Bureau for Lendsqr.

How to use Infobip with Lendsqr as an SMS provider

Lenders can enjoy the best of both worlds: Lendsqr's powerful loan management software combined with Infobip's superior SMS infrastructure.

How to use Loandisk with Lendsqr

Instead of choosing between Loandisk and Lendsqr loan management systems, lenders can access everything from unified platforms, having the best of both worlds.

7 effective debt collection practices and legal considerations

When you choose effective debt collection practices, treat debtors with respect and adhere to the law, you're more likely to collect what you're owed.

How to use Freshchat with Lendsqr for your in-app chat experience

Freshchat and Lendsqr have teamed up to provide a simple communication system you can easily manage and your customers can easily access. Read how!